Understanding the difference between manufacturing costs and production costs can be confusing. Production costs are all the expenses related to a manufacturer conducting its business. Manufacturing costs, as we’ve already discussed, are the expenses that are needed to produce the product. What is bookkeeping The cost of labor includes employee pay, benefits, labor taxes and contributions, and workers’ compensation insurance. You can calculate labor costs in several ways, such as per hour or per product. Keep reading to learn how to calculate total manufacturing cost, how to use the formula, and why it matters.

- Direct labor cost is computed by multiplying the total hours worked by the labor rate per hour, including any additional benefits or payroll taxes.

- The calculation for total manufacturing cost involves a detailed accounting for the costs of materials, labor and overhead.

- Additionally, you can also look for ways to use cheaper or lower-quality materials without compromising product quality.

- Total manufacturing cost is calculated by adding a business’s material, labor, and overhead expenses.

- Much like with direct materials, direct labor costs constitute all labor that goes toward converting materials into finished goods.

CIN7 PRODUCTS

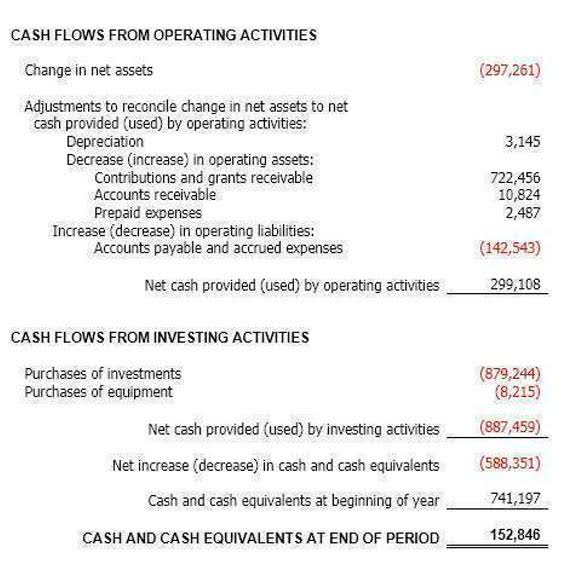

This makes them much more precise than approximating values manually and also provides a good litmus test for comparing the measured KPIs against their theoretical values. Total manufacturing cost is a useful metric in its own right, as we will see shortly. However, it also informs another critically important KPI, namely, the Cost of Goods Manufactured (COGM), which in turn is necessary to calculate the equally important Cost of Goods Sold (COGS). Gaining accurate insight into these cost articles can be easier said than done, however. Though convenient for subscription businesses, recurring billing comes at a cost.

- And for craft brewers, their direct material costs would include the yeast, hops and water used.

- There are a number of ways to optimize your manufacturing process to reduce costs.

- Additionally, TMC can help uncover inefficiencies in the supply chain, shop floor, and inventory levels.

- First, having a complete understanding of these costs makes it easier to benchmark them and determine which ones can be reduced.

- This allows for streamlined data flow between departments, improving overall efficiency.

Total manufacturing cost formula example

Total manufacturing cost includes three key components – direct materials, direct labor, and manufacturing overhead. Understanding these components helps businesses calculate total manufacturing costs accurately. Manufacturing costs are the virtual accountant prices incurred during the manufacturing process.

Latest Caitlin Clark controversy plays into the worst stereotypes about women — and wages war on merit

The value of these raw materials increases over the production of the product. Raw materials go through any number of types of operations in the course of manufacturing, such as welding, cutting, etc. When figuring out direct material costs, it’s important to distinguish between direct and indirect. Indirect costs are subsidiary material costs, such as shop supply costs, perishable tools and equipment costs. Total manufacturing cost is the sum of direct materials, direct labor, and manufacturing overhead.

Dumpster diver saves $20K on Christmas gifts, décor from garbage over holiday season: ‘It is my favorite time going’

Manufacturing overhead includes indirect costs like factory rent, utilities, equipment depreciation, and salaries of supervisors. This rate includes wages, benefits, and any additional payroll costs for the employees directly involved in production. It’s essential to get an accurate rate to properly calculate total manufacturing costs. Calculating manufacturing costs helps determine pricing, control expenses, and maximize profits. Use the total manufacturing cost formula to accurately track production costs and optimize efficiency.

Manufacturing costs are made up of direct materials costs, direct labor costs and manufacturing overhead, which we’ll get to in greater detail shortly. Each of these costs is usually listed as separate line items on an income statement, which is the financial results of total manufacturing cost the business for a stated period. There can be various ways through which a company can manage and control its total manufacturing cost.